CFC YOUR BUSINESS PARTNER FOR AFRICA’S POTENTIAL

Casablanca Finance City (CFC) is an African economic and financial hub located at the crossroads of continents.

Recognized as the leading financial center in Africa and a partner of the largest international financial centers, CFC has built a strong membership community of finance companies, regional headquarters of multinationals, service providers and holding companies.

CFC offers its members an attractive value proposition and quality “doing business” support to promote the deployment of their activities in Africa.Driven by the ambition to satisfy its community,

CFC is committed to promoting the African expertise of its members while stimulating synergies and business opportunities within its network.

Reform of CFC’s legal and tax framework

Reform of CFC’s legal and tax framework

In order to strengthen its attractiveness and comply with international best practices, Casablanca Finance City undertook a series of reforms, transforming its legal and taxation frameworks. This reform does not differentiate between local or exporting activities.

The said reforms were carried out based on the application of several legal texts:

The reform focuses mainly, on the following aspects:

- Broadening of eligible activities

- Reinforcement of compliance rules

- Process simplification for granting the CFC status

Following this reform, the rate card for the CFC status has been revised. It has been modified as follows:

- An application fee is paid to CFCA upon filing of the status request. It is calculated based on the type of company as well as its size and total years of activity.

- The annual fee is paid to CFCA before March 31 of each year, following the closing day of the accounting year. It is also calculated by type of company and now includes two variables:

- The nature of the business activity entering into force from January 1, 2022

- Contribution to the development of the CFC in terms of workforce size entering into force from January 1, 2021

To get an estimated rate card for your company, please reach out to your key contact at CFC.

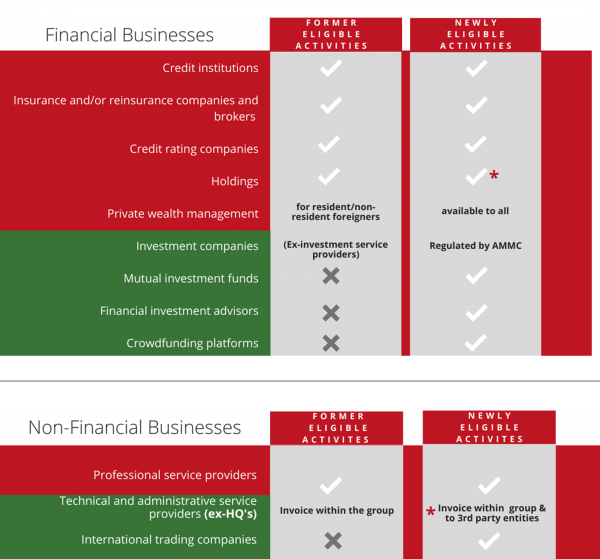

1. Broadening of eligible activities

Following the entry into force of the decree-law on the 1st of October, the CFC status has since opened up to six new business activities: investment companies, mutual investment funds, financial investment advisers, crowdfunding platforms, trading companies and regional headquarters of multinational companies. The latter can now invoice transactions for goods and services within the group, and to third party entities. This expansion will allow CFC to increase the flow of investments.

*Holding companies will henceforth be considered as Financial Institutions, regardless of the share they hold in the capital of their international subsidiaries, majority or not.

* HQ’s will now be able to invoice transactions for goods and services within the group, and to third party entities.

2. Reinforcement of compliance rules

This reform also includes new compliances rules for CFC companies:

- Provide an added value to the development of CFC

- The general manager, must reside in Morocco

- Allocate a minimum of operating expenses in line with the activity of the company

- At least one senior executive must have qualifying international experience

- Minimum of 3 years for service providers (administrative, technical, ancillary, trading)

- Minimum of 1 year for all other activities

In the event that these requirements are not met, penalties may apply as stated by the law.

- 12 month suspension of the CFC status, with possible withdrawal

- Penalty fees for failure to respect submission deadline of annual report

Companies who’ve obtained the CFC status before October 1, 2020, have until December 24, 2021 to be in compliance with the new regulations.

3. Process simplification for granting the CFC status

The CFC status process has been streamlined for maximum efficiency. CFC Authority assesses and approves the application for the Status. CFCA, then, submits proposals for granting “CFC Status” to the Ministry of finance. For regulated activities, CFCA requests an opinion from the relevant supervisory authority.

The processing of requests is henceforth reduced to a period of 30 working days.

Tax Reform

Another major reform relates to CFC’s tax framework:

- A corporate tax of 15% is applied to all CFC companies, except banks and insurance/reinsurance companies

- The new regime includes the exemption from withholding tax on dividends distributed to residents and non-residents

Transitional period: CFC members still benefiting from the former tax regime have until December 31, 2022 to comply.

By January 1, 2023, all CFC companies will be subject to the same corporate tax (15%).

*except banks and insurance/reinsurance companies

These new regulations will improve Casablanca Finance City’s value proposition and reinforce its international credentials as a trusted financial hub in Africa

For any questions or additional information, contact us: contact@cfca.ma

CFC IN NUMBERS

1st Financial Center in Africa (GFCI, 2021)

~200 companies with CFC Status

50 African countries covered by CFC’s companies

1st green financial center in Africa and the Middle-east (GGFI, 2021)

20 South-South partnerships

15 partnerships with international financial centers

OUR VALUES

Preserving the environment is a prerequisite for the sustainable development of CFC.

Preserve the integrity and diversity of nature by minimizing the impact on the environment, by considering the environmental impact of all decision-making and promoting the sustainable use of natural and energy resources.

Respect dignity and human rights by appreciating the differences. Every company with the “CFC Status” must ensure compliance with the labor regulations in force and refrain from using forced labor or child labor. In addition, the intolerance of discrimination towards staff, the hiring candidates, customers and business partners or suppliers. They must also respect and value the diversity of people and promote their personal and professional development taking into account their differences.

Act with integrity and respect for professional ethics.

In order to maintain CFC’s reputation, balance and prosperity and build a culture of trust and accountability, CFC members must act with integrity and ethics in their dealings with their customers and other market players.

Demonstrate competence and ensure the adequacy of all means and services.

Every company must act with skill and diligence in relation to the services it provides. To serve this purpose and to carry out its activities, it must always be sufficiently equipped to meet the demands of its activities and in conformity with the international standards, namely in terms of human resources, competent resources, efficient and secure technical resources and an appropriate organization and adequate internal procedures.

Promote transparency and confidentiality of data.

To build trust and promote informed and accountable decision-making, it is essential to enable transparency and to refrain from deceptive or fraudulent practices and acts, while respecting the obligations of professional secrecy, confidentiality and protection of personal data.

Morocco has strong assets, allowing it to serve as the preferred entry point to Africa:

Political Stability

- Monarchy dating back over 12 centuries

- Stable and secure environment

Privileged geographical location

- Located at the confluence of the Atlantic and the Mediterranean, of which it is the first gateway, the Kingdom of Morocco enjoys a unique geo-strategic position that allows it to be located at the crossroads of several civilizations (Tangier is less than 14 km from Europe) as well as act as a moderator of a three-dimensional economic dialogue that gives access to a potential market of nearly one billion consumers.

Transport, Infrastructure & Connectivity to Africa

Morocco is the 2nd country with the best infrastructure in Africa (WEF 2019). It has the best maritime connectivity in Africa and is ranked 16th in the world. Morocco has 16 international airports, with Casablanca as the 1st Europe-Africa hub. From Casablanca, 33 direct flights are scheduled to African destinations.

Solid economic fundamentals

- Morocco has put in place “solid macroeconomic policies and reforms that have contributed to reducing internal and external vulnerabilities, improving fiscal and financial policy frameworks and increasing economic diversification”. Source: IMF, 2017

- Fitch Ratings and Standard & Poor’s maintained Morocco’s investment grade rating since 2007 and ranks Morocco third in Africa.

- According to the IMF and the World Bank, Morocco is 3rd in Africa (after Mauritius and Rwanda), gaining 7 points in the “Doing Business 2020” index.

A strong African anchor

Morocco has a strong economic footprint in Africa as more than 85% of Morocco’s Direct Foreign Investment (FDI) goes to Africa. The Moroccan financial sector (banking, insurance) is present in 34 African countries. The Saham group is present in 27 countries, BMCE BANK in 20 countries, Attijari Wafabank in 14 countries and the Banque Populaire group in 17 countries. Morocco is the 2nd largest intra-African investor in Africa with a total of 22 projects valued at $ 5 billion in 2017.

Cooperation between governments is very positive and strengthened through 46 royal visits to 25 countries since the enthronement of His Majesty King Mohamed VI in 1999 and through the establishment of cooperation agreements with 42 countries.

Africa stands out as the next global growth driver

- Africa will have a global GDP of $ 29 trillion in 2050

- 24 African countries will grow at an average annual growth rate of at least 5% by 2030

- 70% of African households will have a purchasing power greater than $ 5,000 in 2025

- Urbanization is growing: 100 African cities with more than 1 million inhabitants in 2025

- The infrastructure needs are important: 90 billion dollars / year until 2020

- African labor force will be 1.1 billion in 2035